Published February 10, 2026

Here’s the uncomfortable truth: most people know they’re vulnerable, but they wait until the damage is done to act.

A recent Nationwide survey found that 80% of people worry about identity theft, yet only 16% actually carry protection. Meanwhile, 77% have just… accepted it as normal. That’s not risk management. That’s resignation.

And in business? The pattern is identical. We’ve watched Phoenix-area companies decline baseline security, delay compliance work, and ignore IT professionals, only to scramble for damage control after a breach, a wire-fraud loss, or a regulatory slap. By then, the cost isn’t just technical. It’s reputational, legal, and existential.

This post isn’t about fear-mongering. It’s about showing you the documented gap between “I know I should” and “I actually did”, and what fills that gap when attackers show up.

The Negligence-to-Consequence Pipeline: Six Real Patterns

These aren’t hypotheticals. These are anonymized composites based on real interactions we’ve seen in Valley, paired with publicly documented outcomes that show what happens when “later” never comes.

1. Healthcare: “Not This Year”

The Pattern:

A Phoenix-area health service provider declines email hardening, password managers, and MFA because “the team isn’t ready yet.” They rely on “human judgment” to catch phishing and defer compliance work indefinitely.

The Data:

According to Verizon’s 2024 Data Breach Investigations Report, 68% of breaches included a non-malicious human element, errors or people falling for social engineering. That’s not a rounding error; that’s the primary attack surface. And 32% of those breaches included extortion (ransomware).

The Consequence:

In any HIPAA-regulated environment, documented refusal of baseline controls makes it nearly impossible to argue “reasonable efforts” after an incident. Opposing counsel will ask: “You were advised to implement MFA in March. You declined. The breach occurred in August. What changed?”

The answer “we were planning to” doesn’t hold up when patient data is on the dark web.

Local Context:

For Mesa and Phoenix health clinics handling electronic PHI, “later” mentality isn’t just risky, it’s a compliance liability the moment OCR starts asking questions.

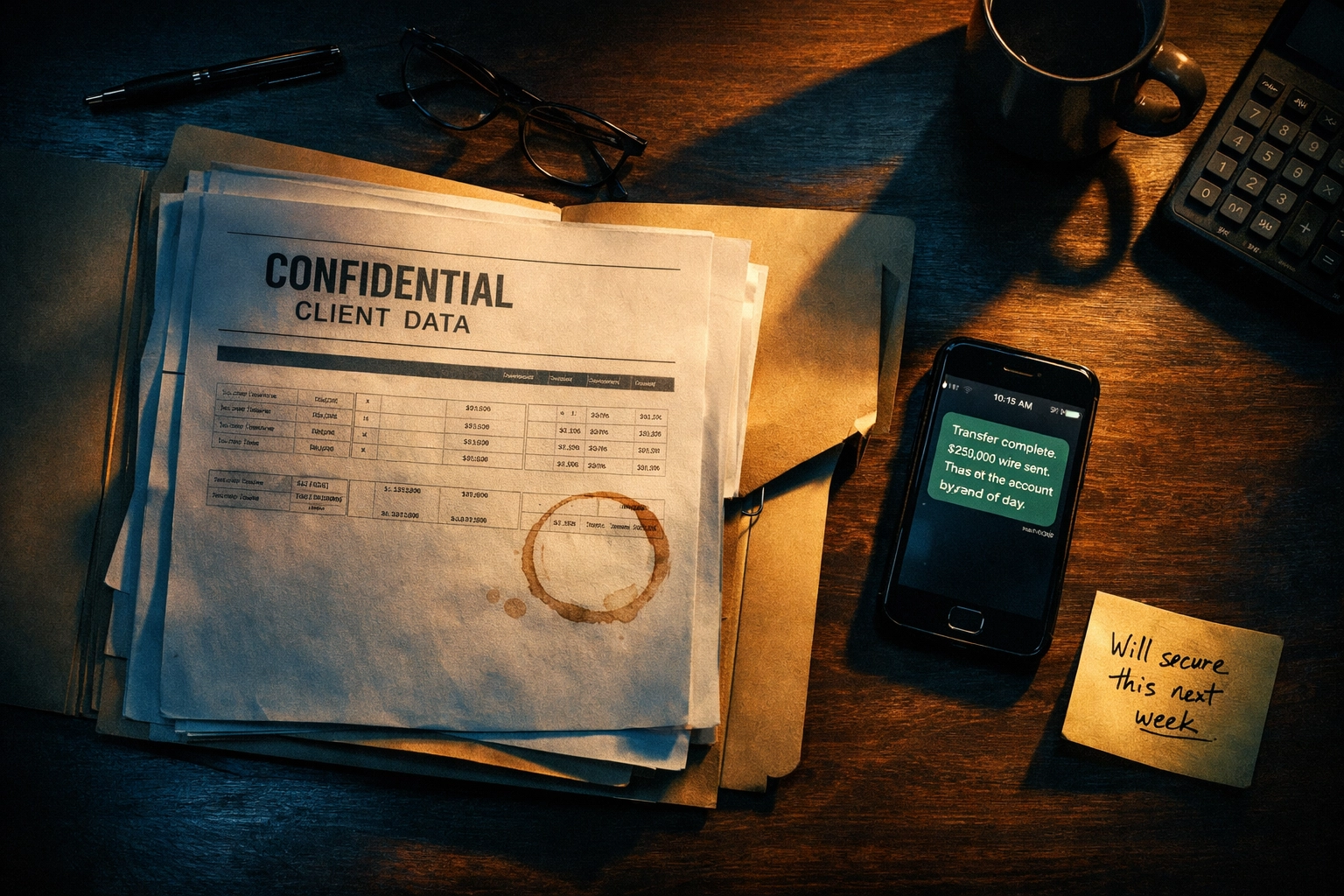

2. Real Estate & Mortgage: “Turn Off the Safety Net”

The Pattern:

A Scottsdale agent or Valley mortgage broker disables automated email protections because prompts are “annoying.” They insist they’ll manually review everything, even in workflows involving six-figure wire transfers.

The Data:

FinCEN’s analysis on Business Email Compromise (BEC) in real estate explains that attackers specifically target businesses conducting large wire transfers via email. The FBI’s 2023 IC3 report logged 21,489 BEC complaints with adjusted losses over $2.9 billion.

That’s billion. With a B.

The Consequence:

When a fraudster successfully hijacks a closing email thread and redirects a $180,000 wire, dispute becomes “who failed to follow reasonable controls?” And “we turned off the safety feature because it was inconvenient” is both discoverable and indefensible.

The buyer may sue the agent. The title company may sue the broker. And everyone points at the person who disabled the one tool that would have flagged the fake wire instructions.

Local Context:

In Arizona’s hot real estate market, the speed of closings creates pressure to “move fast.” Attackers know this. They exploit the urgency. And they win when convenience beats caution.

3. Creative Services: “I Can Evaluate Phishing Myself”

The Pattern:

A Phoenix-based photographer or designer requests that anti-phishing quarantine be disabled so they can personally review blocked messages, even after being shown an active credential-harvesting attempt that nearly succeeded.

The Data:

Again, Verizon DBIR: more than two-thirds of breaches include a non-malicious human element. Confidence does not equal control. The attacker isn’t betting you can’t spot phishing. They’re betting you’ll spot 49 out of 50, and they only need one.

The Consequence:

For creative professionals, credential theft commonly cascades into:

- Mailbox takeover (attacker impersonates you to clients)

- Client payment redirection (“hey, use this new invoice link”)

- Ransomware/extortion targeting your portfolio and client files

The “cost” isn’t just IT recovery. It’s lost contracts, reputational damage, and potential liability if a client’s payment was stolen through your compromised account.

4. Travel Services: “I’ll DIY It to Save Money”

The Pattern:

A travel agent or small agency leaves managed IT services to cut costs, then suffers an account compromise months later and urgently re-engages for cleanup, while still resisting preventive spend.

The Data:

A Check Point-reported phishing campaign leveraged compromised travel-agency accounts to target over 7,300 companies and 40,000 individuals. Microsoft Threat Intelligence also documented an ongoing campaign impersonating Booking.com to deliver credential-stealing malware and enable financial fraud.

The Consequence:

Travel workflows concentrate identity and payment data, and they run almost entirely on email. Once an agent’s inbox is compromised, attackers can:

- Steal client credit card details and passport scans

- Use the “known sender” trust to phish the agent’s entire client list

You’re not just losing your own data. You’re weaponizing your credibility against your customers.

Local Context:

Phoenix travel agencies that book for snowbirds and seasonal residents handle high volumes of sensitive PII. One compromised account can burn years of client relationships in a single afternoon.

5. Tax Preparation: “We’ll Tighten It Up Later”

The Pattern:

An Arizona CPA or tax prep firm continues using consumer-grade tools, delays endpoint controls and logging, and defers a formal security program, even after being warned about regulatory expectations.

The Data:

- IRS Publication 4557 (“Safeguarding Taxpayer Data”) provides explicit guidance.

- The FTC Safeguards Rule (16 CFR Part 314) requires a comprehensive written information security program with administrative, technical, and physical safeguards appropriate to business and data sensitivity.

- TaxSlayer FTC Settlement: Hackers accessed nearly 9,000 accounts and used the data for tax identity theft. TaxSlayer agreed to settle FTC allegations including failures to have an adequate written security program or risk assessment.

The Consequence:

In tax work, “we knew and delayed” plus “no written program” is exactly the posture regulators and plaintiffs zoom in on, because it speaks to foreseeability and reasonableness. If you had guidance, ignored it, and got breached, the outcome isn’t “unfortunate.” It’s negligent.

Local Context:

Arizona CPAs handling W-2s, 1099s, and SSNs are directly in scope. The FTC doesn’t care that you’re a two-person shop. The rule applies. And “we’ll get to it next quarter” isn’t a defense.

6. Mortgage & Finance: The “$700 Question”

Important Clarification:

The risk isn’t “a cheap website causes a breach.” The risk is DIY/cost-minimization mindset applied to regulated customer data, manual exports, untracked migrations, weak identity controls, and resistance to paying for professional security work.

The Pattern:

Repeated resistance to structured IT projects. Attempts to “save money” by handling sensitive data migrations manually. Proposes forwarding customer files or exporting loan data to personal drives “because it’s faster.”

The Data:

The FTC Safeguards Rule explicitly requires:

- A written information security program

- Risk assessment

- Safeguards testing and monitoring

- Service-provider oversight

- Ongoing evaluation and adjustment

Not ad-hoc. Not “we’ll figure it out.” Written. Tested. Monitored.

The Consequence:

In mortgage and finance, “cheap DIY” instinct surfaces as informal data handling, shared drives, forwarded emails, unmanaged personal devices. That’s where you lose auditability, access control, and incident containment. And when regulators or plaintiffs ask, “How did loan applicant data end up on an unencrypted laptop?” the answer “we were trying to save money” makes it worse, not better.

Local Context:

For Arizona mortgage brokers working in a competitive market, cutting corners on compliance infrastructure feels like smart business, until the data walks out the door and penalties start stacking.

Why “Later” Is the Most Expensive Decision You’ll Make

The 2017 Equifax breach, caused by unpatched vulnerabilities and outdated systems, exposed 147 million consumers and cost $700 million to settle. A single missed software update at a major credit agency exposed over 140 million people. A misconfigured cloud storage bucket at a prominent tech company leaked millions of users’ files.

The pattern? Most cybersecurity disasters stem from negligence, not sophistication. Attackers didn’t break in with zero-day exploits. They walked through doors that were left unlocked because someone said, “We’ll fix that next quarter.”

And here’s the kicker: the financial and reputational cost of reacting to an incident almost always exceeds the cost of preventing it. The Nationwide survey showed that only 51% of consumers even understand how identity theft impacts credit scores. The knowledge gaps create a false belief that protection is expensive and complicated, when in reality, delay is what costs you everything.

What “Reasonable Effort” Actually Looks Like

If you’re a Phoenix-area business handling customer data, here’s what regulators, insurers, and courts expect as baseline “reasonableness”:

- Multi-Factor Authentication (MFA) on all business accounts: no exceptions.

- Email security with DLP and anti-phishing: something that stops plaintext SSNs and wire instructions from leaving your inbox unencrypted.

- Endpoint Detection and Response (EDR): because “I have antivirus” hasn’t been enough since 2019.

- A written information security program: even if you’re a solo CPA. The FTC doesn’t grade on company size.

- Encrypted endpoints: so a stolen laptop is an insurance claim, not a breach notification.

None of this requires a CISO or a $200K security budget. It requires deciding that “later” stops being an option.

The Bottom Line

We’ve seen too many Phoenix-area businesses treat security advice like a suggestion: something to “get to eventually.” And we’ve watched what happens next: frantic calls, regulatory letters, client lawsuits, reputational damage that takes years to repair.

You don’t have to be a cybersecurity expert. You just have to stop waiting for the perfect moment and start with a reasonable baseline. Because attackers? They’re not waiting.

Ready to stop gambling with “later”? Let’s build a security plan that fits your business: before the conversation becomes about damage control. Schedule a free 30-minute intro call here and let’s talk about what “reasonable effort” actually looks like for your Phoenix-area business.

Your Personal Ninja doesn’t just fix problems. We help you avoid becoming the next cautionary tale.