In exchange for signing up for new cards, many card issuers will give you something called a “sign up bonus.” These bonuses can be cash or points in exchange for spending a certain amount of money within a certain time frame.

The number of points you earn for each dollar spent varies between cards. The Chase Sapphire cards, for instance, provide bonus points for travel purchases but aren’t the best option for making purchases on sites like Amazon. If you need a place to begin, look at the cards I have. https://myaz.tech/maxrewards.

There is a common misconception that having multiple cards is bad. Having multiple cards isn’t always a bad thing. You can begin to profit in a variety of ways as long as you are not overspending or maxing out your balances and are paying them off on time. For one, it boosts your total amount of available credit, which can be used for future purchases. This also improves your credit scores and overall credit outlook. In addition, it broadens the scope of your point accumulation, increasing the amount of money you can earn back on everyday purchases.

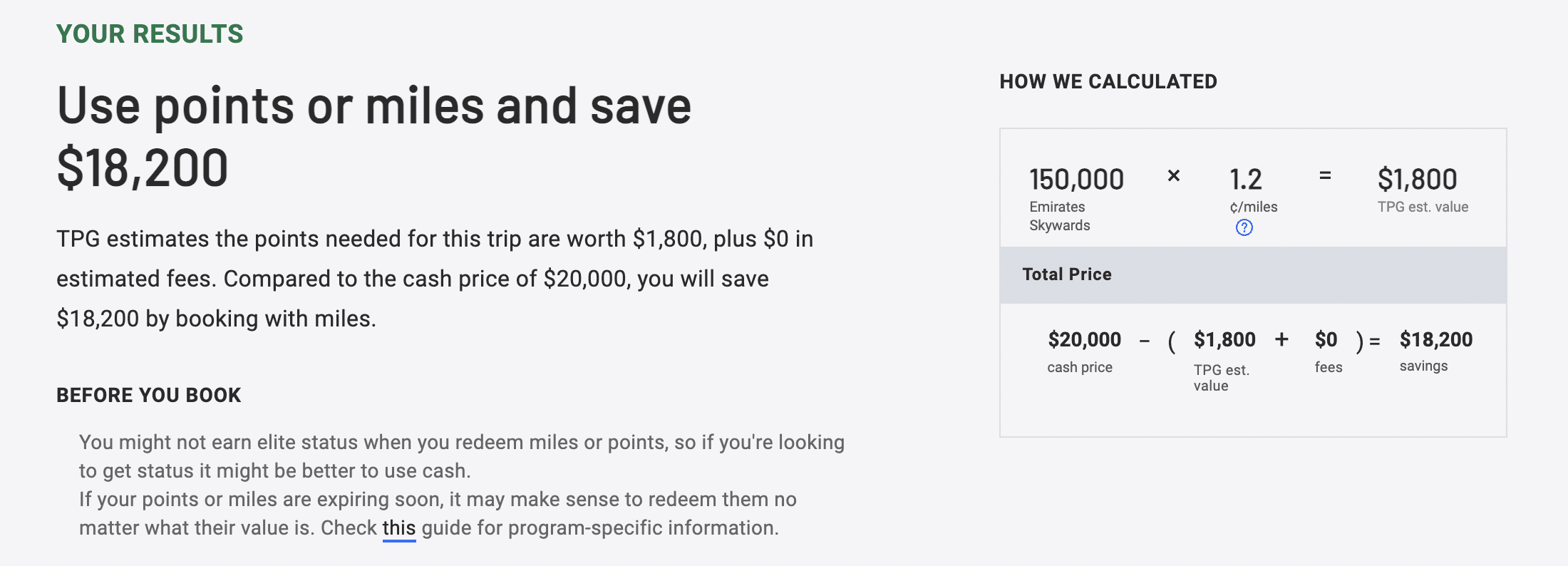

The points you earn can be turned in for a wide range of things, like statement credits, gift cards, and even trips. However, the greatest value is typically found when traveling. You can save a lot of money on airfare by transferring your points to your preferred airline and purchasing a reward ticket. The first-class ticket on Emirates Airlines Suite is one of my favorite redemption examples. Seriously. Take a look at this. The price of these tickets is $20,000. When paid for in points, the estimated amount required to purchase one is only 150,000 points, which, if you use a welcome bonus (or SUB), will cost you no more than your daily living expenses. This can be a money-saver on almost any airline flight.

If you want the actual math of the points vs. dollar amount in this example, see below:

Given the breadth of material one could cover on the topics of points’ worth, optimizing redemptions, and avoiding point waste, I’ll be skimming the surface here. You can find advice on that topic in TPG’s beginner guide in the citations at the bottom of the page.

Just in case the free trips aren’t enough. The majority of issuers will also provide discounts for use at select retailers. For instance, you could spend X and recoup X. One year, for example, I saved 50% on Dropbox.

If you take anything away from this article. I want you to go out with the knowledge that any number of possibilities await you if you just play your cards right.

Keep the following points in mind:

- When redeeming points, it’s always best to do so through a transfer to a partner airline.

(SeeWe’ll gladly reward you with our concierge service in a similar way with much less effort on your part if you don’t want to spend all that time making sure you’re maximizing. Send us a message! 🙂 TPG Beginner Guide in Citations.) - If you use the wrong card for your purchases, you will lose out on points.

- It’s often worthwhile to apply for a new card.

If you don’t want to spend all that time making sure you’re maximizing, we’ll gladly reward you with our concierge service in a similar way with far less work on your end! Drop us a line! 🙂

References:

Share this:

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on Tumblr (Opens in new window) Tumblr

- Click to share on X (Opens in new window) X

- Click to share on Pocket (Opens in new window) Pocket

- Click to share on Pinterest (Opens in new window) Pinterest

- Click to share on LinkedIn (Opens in new window) LinkedIn

You must be logged in to post a comment.