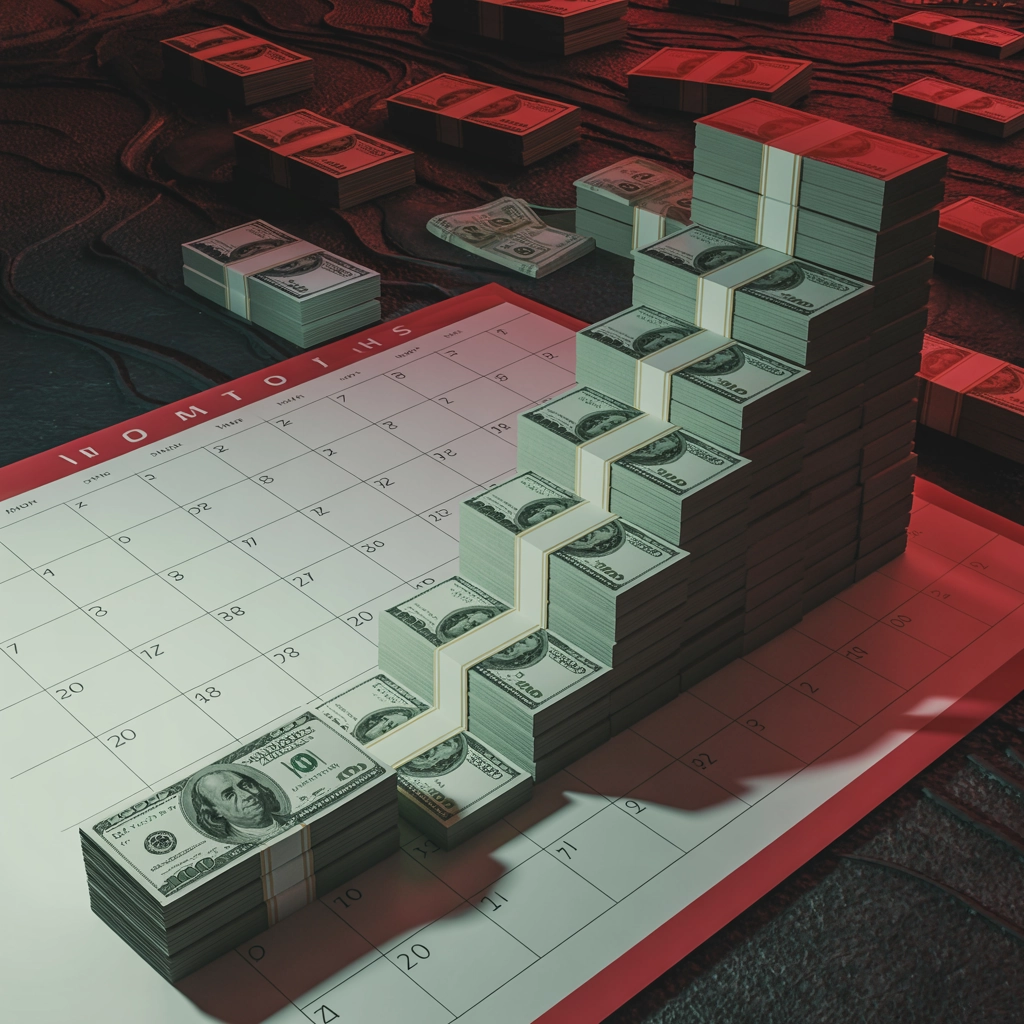

Imagine watching a $100 bill silently transform into a $1,500 financial nightmare that haunts you for seven years. Or seeing that $300 service fee you decided to “deal with later” balloon to nearly $2,000. This isn’t some horror story—it’s basic math combined with the reality of how contracts and collections work in the real world.

The Accountability Crisis

Let’s be honest: most people who end up in collections weren’t ambushed. They made a conscious choice to ignore clear contractual obligations and multiple warnings. While there are occasional exceptions and honest mistakes, the vast majority of collection cases stem from people who simply decided their agreements were optional.

This avoidance behavior doesn’t just hurt businesses—it damages the entire economic ecosystem, raising prices for everyone and eroding the trust that makes commerce possible. At Your Personal Ninja, we see this play out in the cybersecurity space when clients ignore maintenance contracts until after they’ve been breached—when the costs are exponentially higher.

The Mathematics of Avoidance

When you sign a contract (either physically, verbally or digitally by clicking I agree) and then ignore it, the numbers don’t stay static—they grow. And they grow fast. Let’s break down exactly how this happens with realistic examples.

$100 Debt Escalation Example (2% monthly interest + $25 late fee):

| Timeline | Amount Owed | Multiple of Original |

|---|---|---|

| Original | $100 | 1x |

| 6 months | $270 | 2.7x |

| 12 months | $462 | 4.6x |

| 24 months | $921 | 9.2x |

| 36 months | $1,504 | 15x |

$300 Debt Escalation Example (2% monthly interest + $25 late fee):

| Timeline | Amount Owed | Multiple of Original |

|---|---|---|

| Original | $300 | 1x |

| 6 months | $496 | 1.7x |

| 12 months | $716 | 2.4x |

| 24 months | $1,243 | 4.1x |

| 36 months | $1,912 | 6.4x |

These aren’t extreme examples. A 2% monthly interest rate (24% annually) and a $25 monthly late fee are standard in many industries. The math is clear and brutal—that $100 bill becomes $1,504 after just three years of avoidance.

The Professional Time Investment Reality

Collection isn’t just about the original amount owed—it’s about recovering the significant costs associated with pursuing payment. When companies charge for collection efforts, they’re not being punitive—they’re recovering legitimate business expenses.

Consider this:

- Legal professionals charge $100-500+ per hour for collection work

- Each collection requires multiple contacts, documentation, and potentially legal filings

- Every hour spent chasing a delinquent account is time not spent serving paying clients

- Collection efforts come with no guarantee of success, despite the significant investment

This is why businesses often include collection costs in their contracts. Just as you wouldn’t expect a lawyer to work for free, businesses can’t absorb the professional costs of chasing payments without compensation.

The Credit Destruction Timeline

The moment your account hits collections, your credit takes a hit—before any payment is collected. That negative mark stays on your credit report for seven years, affecting everything from:

- Mortgage applications and rates

- Auto loans and leases

- Rental applications

- Credit card approvals

- Employment opportunities (yes, many employers check credit)

- Insurance premiums (in many states)

That $100 you avoided doesn’t just cost you the escalated amount—it costs you thousands more in higher interest rates and missed opportunities over those seven years.

The Human Element

Here’s the truth that collection agencies don’t want you to know: most businesses will work with customers who communicate honestly about payment difficulties.

“Virtually every company out there is going to work with you if you say you can’t afford something you are being billed for. Hostility and escalation can be avoided if you take the right approach. Just be nice, professional and communicate.”

When accounts go to collection agencies, businesses typically lose 25-50% of the amount collected to commissions.

This means companies have a strong financial incentive to work directly with you instead of outsourcing to collections.

A Step-by-Step Guide: The Prevention Playbook

If you find yourself unable to meet a financial obligation, here’s the proven playbook for preventing that $100 from becoming $1,500:

- Face Reality Early: Open those emails. Read your contracts before and after signing them. Understand what you’re agreeing to.

- Communicate Immediately: As soon as you realize you might miss a payment, reach out. A simple email or phone call can prevent escalation.

- Be Honest About Your Situation: Explain your circumstances clearly. Most businesses have heard it all before and appreciate transparency.

- Ask for Options: Request a payment plan, reduced interest, or hardship program. These exist at most companies but are rarely advertised.

- Get It in Writing: Once you’ve reached an agreement, make sure it’s documented in writing, even if just in an email confirmation.

- Set Calendar Reminders: Don’t miss the renegotiated payments. Each missed payment can reset the escalation process.

- Follow Through: Your credibility matters. If circumstances change again, communicate before missing a payment.

At Your Personal Ninja, we apply these same principles to our cybersecurity contracts—we’d rather work with a client through temporary difficulties than see them face a preventable breach because they avoided maintenance.

The Contract Reality Check

Contracts exist because trust is essential for business—they’re not arbitrary documents designed to trap you. When facing a potential payment issue, ask yourself:

- “If I don’t address this now, what will this debt look like in three years?”

- “Can I afford to damage my credit for seven years to avoid a small payment today?”

- “What’s the real cost of waiting versus making a call now?”

The math doesn’t lie: a few minutes of potentially uncomfortable conversation can save you thousands of dollars and years of credit damage.

The Professional Standards Solution

The solution to avoiding the $100-to-$1,500 nightmare is remarkably simple:

- Communicate honestly when payment issues arise

- Understand that payment plans are standard business practice

- Recognize warning signs before they become crises

- Follow through on your commitments

As cybersecurity professionals at US Tech Support Solutions, we see the parallel between ignored contracts and ignored security warnings—both lead to exponentially higher costs down the road. Prevention and early intervention are always less expensive than crisis management.

The Bottom Line

Taking responsibility for your agreements isn’t just about avoiding financial penalties—it’s about maintaining your integrity, protecting your credit, and ensuring your future financial health.

The next time you’re tempted to ignore a bill or contract obligation, remember the mathematics of avoidance. That temporary relief of not dealing with a $100 problem today could cost you 15 times that amount tomorrow, along with your credit score and peace of mind.

Be the exception. Communicate early, follow through on your commitments, and keep your financial future secure. Your future self will thank you for the thousands of dollars saved and the stress avoided.

At Your Personal Ninja, we help businesses manage their technical obligations proactively—because we know that prevention is always cheaper than crisis management. Visit our website to learn more about how we can help you stay ahead of both cybersecurity and contractual challenges.

Share this:

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on Tumblr (Opens in new window) Tumblr

- Click to share on X (Opens in new window) X

- Click to share on Pocket (Opens in new window) Pocket

- Click to share on Pinterest (Opens in new window) Pinterest

- Click to share on LinkedIn (Opens in new window) LinkedIn