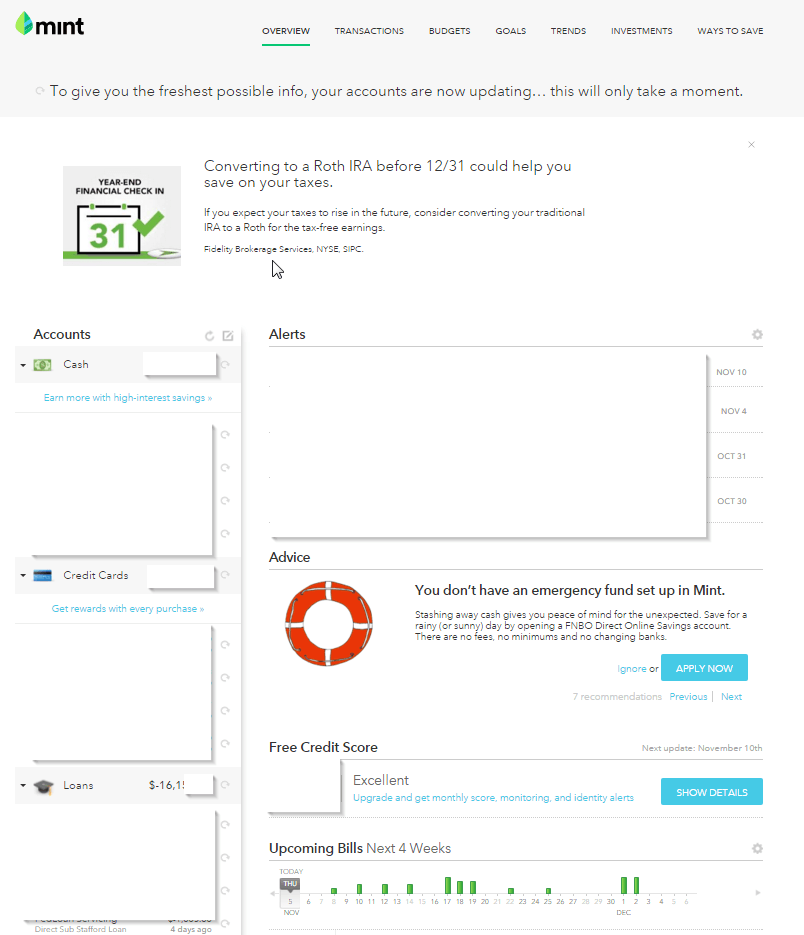

Mint is a fantastic web app that can help you create budgets, show your spending and income as well as help you create goals to save. It also periodically checks your credit and can show you an up to date credit score. Their dashboard also shows any upcoming bills it catches, and also gives you the chance to put bills due in. All you need to do is link all the accounts you have.

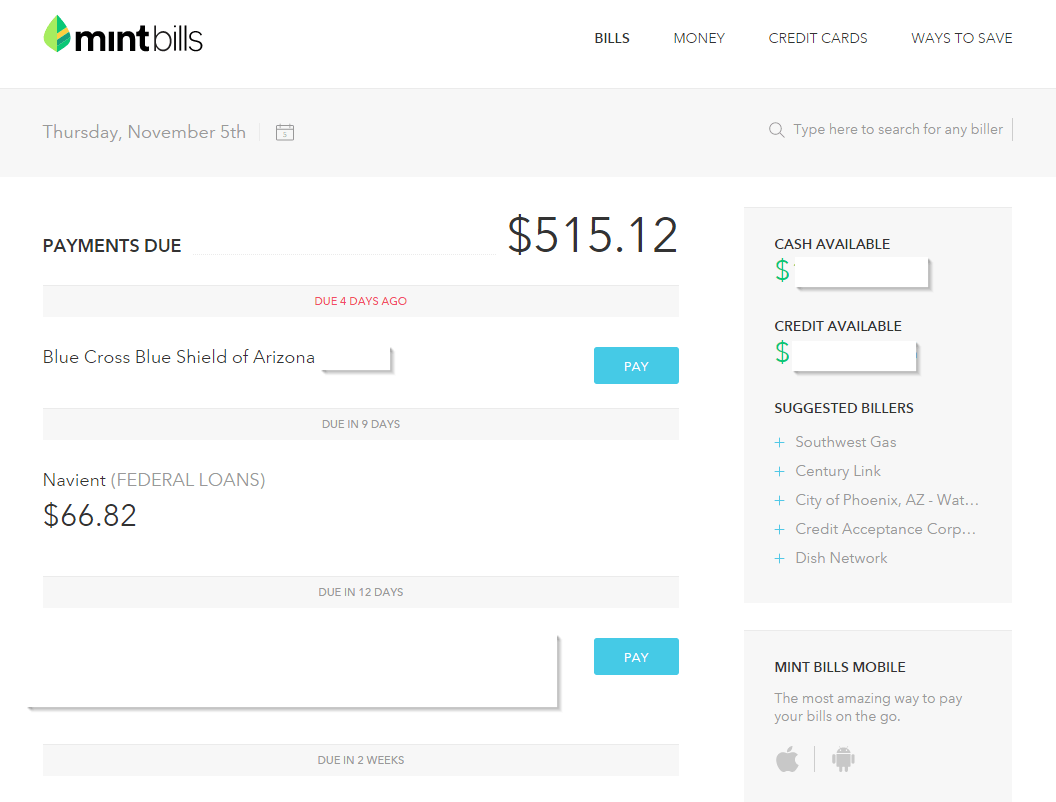

Mint Bills

While Mint focuses on just an overall of your finances and money. Mint bills focuses specifically on bills that may be due. It interfaces with each account, just like Mint, and pulls your current balance due. Mint bills also offers the ability to pay your bills through their application.

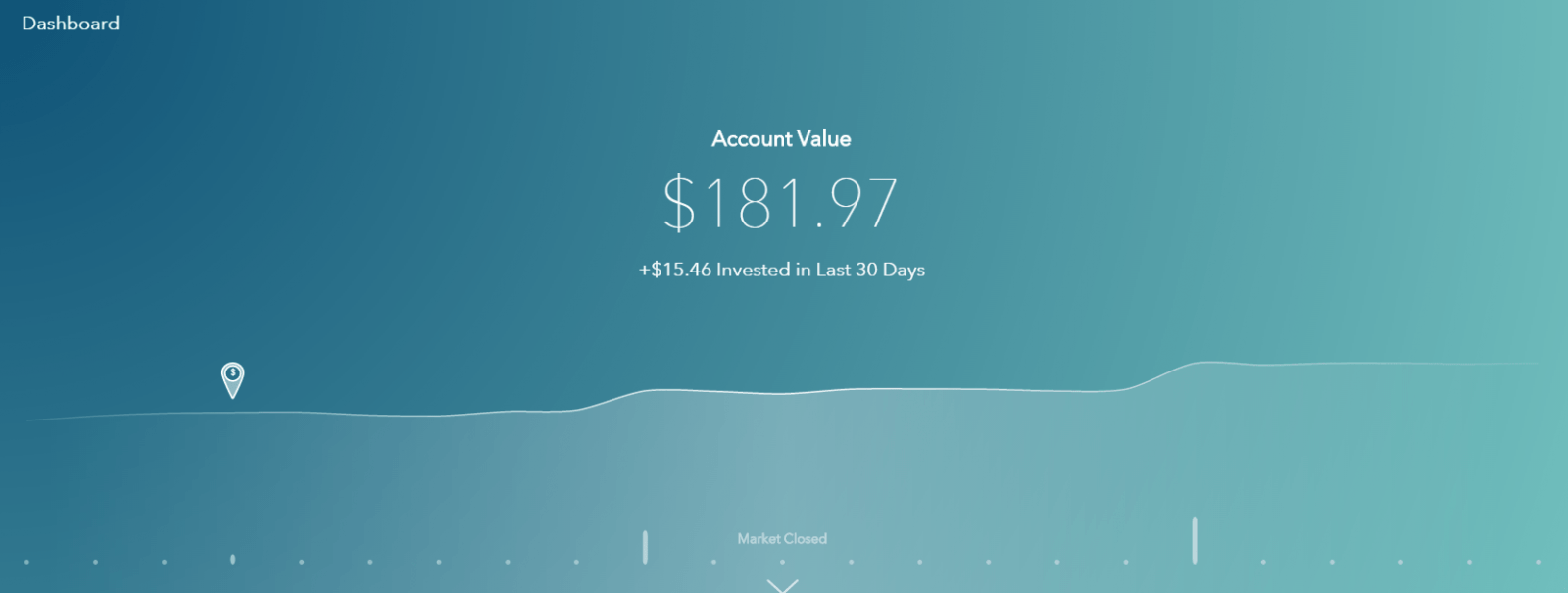

Acorns

Acorns is a nifty little app that you link to your debit/credit cards that invests your spare change. It costs $1/month, but in the long run will automatically play the stocks for you. There’s an Android and iOS app.

Digit

If you’ve ever wanted to start a savings account but never managed to get those auto transfers going or never could figure out how much to put in, here’s the app for you. Digit analyzes your spending and determines automatically how much you can save and puts it in a savings account for you.

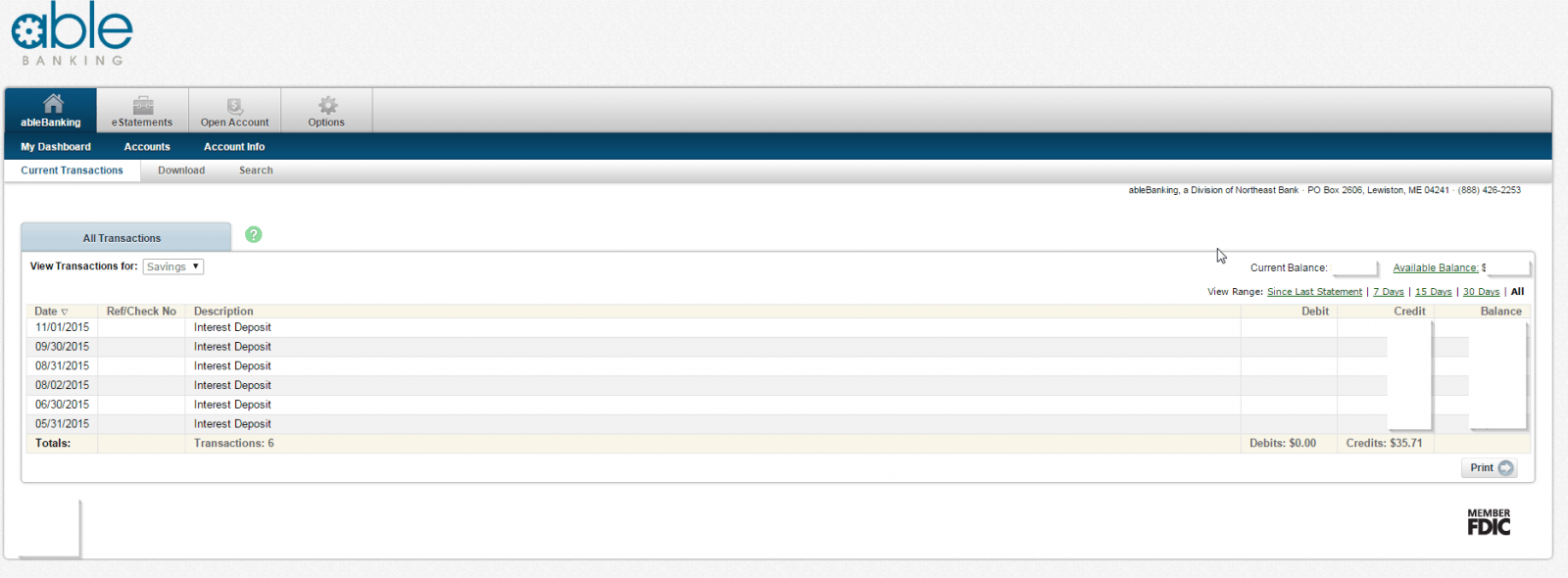

Able Banking

Able Banking has Savings accounts that offer a whopping 1% interest rate. If you happen to open one, don’t forget to put my name down under how did you hear about us (Joseph Greenbaum).

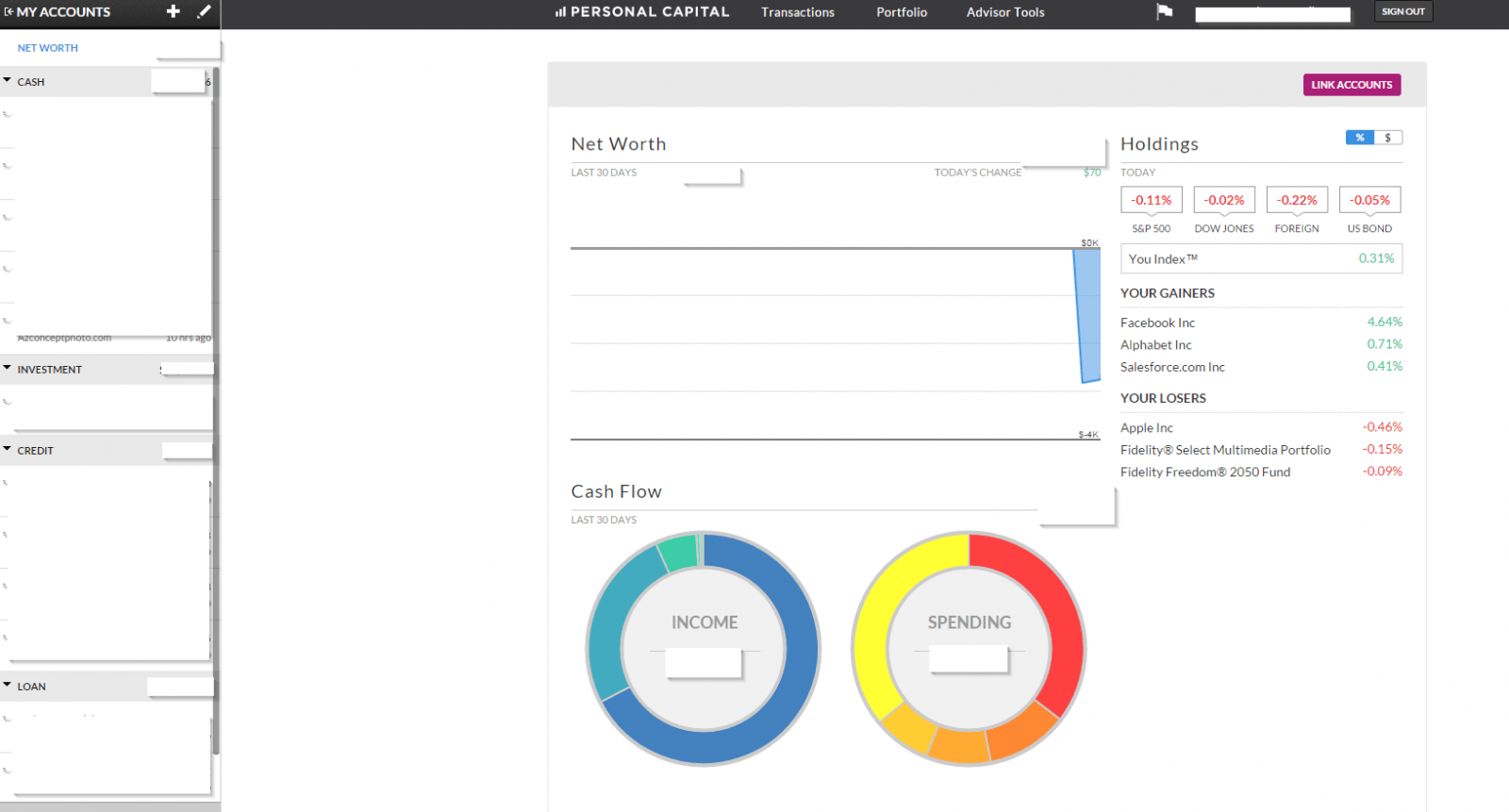

Personal Capital

Much like Mint. Personal capital has you link your accounts. Though while mint focuses on budgeting and saving, Personal Capital focuses more on long term investing.